Feeling overwhelmed with family dynamics, the loss of a loved one, and what to do with a family property and its contents? Deciding whether to sell a family home after the death of a loved one can be a difficult and emotional process.

Here’s a guide to help you make an informed decision:

1. tHE DISCOVERY PROCESS

- Evaluate everyone’s emotional attachment: The family home may hold sentimental value and memories that are important to some, but not all family members. Consider how attached you are to the property and whether you’re ready to let go of those memories.

- The family members involved will need to come together to decide what to do with the property or properties in many cases. While it is easy when the whole family agrees, that is not always the case. It’s normal to have different points of view, but going through this process is necessary to find a common goal for ALL the family members involved.

2. THE property’s FINANCIAL OUTLOOK

- Assess your financial situation: Consider any outstanding debts, mortgages, or other financial obligations associated with the property, as well as any costs related to maintaining it. You may also want to consider each family member’s personal financial situation and whether they can afford to keep the home.

- Consider practical considerations: Maintaining a home can be expensive and time-consuming, especially if it is in need of repairs or renovations. Think about the practicality of keeping the home, including the time and resources the family is willing to invest.

3. how is the property held?

How is the property held: in a Trust, Estate, or was it willed?

The way in which a property is held can greatly impact the process of selling it, particularly when it comes to family homes. If the property is held in a trust, there may be specific guidelines and restrictions outlined in the trust documents that must be adhered to during the sale process. If the property is part of an estate, there may be additional considerations, such as probate court proceedings, that must be taken into account. If the property was willed to a specific individual, that individual may have the final say in the sale of the property.

It’s important to understand who, if anyone, is in charge of the property and what restrictions, if any, exist in regards to what can or cannot be done with the property. These considerations can impact the sale process and should be thoroughly reviewed before making any decisions. Working with a professional who is familiar with these types of situations can be especially helpful in ensuring that the sale of the family home is conducted in a way that is compliant with all necessary regulations and guidelines.

4. Consider your family’s future plans

When considering the sale of a family home, it’s important to take into account the future plans of not just the individuals involved in the sale, but also the future plans of the family as a whole. Think about your future living arrangements, or whether the family is not using the home as much as they used to, and whether keeping the home fits with your family’s long-term plans. This can include things like upcoming family events, such as weddings or the arrival of grandchildren, as well as any future financial goals the family may have as a whole. It’s important to have open and honest communication about these plans and how the sale of the property may impact everyone, both positively and negatively.

Additionally, considering the future plans of the family can help inform decisions around timing of the sale, as well as what type of property, if any, the family may want to possibly purchase in the future. Taking these factors into account can help ensure that the sale of the family home is a smooth and successful process that aligns with the needs and goals of the family as a whole.

5. SEEK ADVICE FROM EXPERTS

It is good to connect with a Broker/Realtor®, who is experienced in these matters, real estate attorney, real estate appraiser, or accountant, tax attorney or financial advisor to help you assess the financial and practical aspects of selling the home.

Connecting with professionals in the real estate industry can greatly benefit those who are considering selling their family property. An experienced broker or Realtor® can provide valuable insight and guidance on the current real estate market, and the best strategies for selling your property.

Additionally, a real estate attorney can help navigate any legal issues that may arise during the sale process.

An appraiser can help determine the fair market value of the property, which can be useful in negotiations with potential buyers.

Finally, speaking with an accountant, tax attorney, or financial advisor can help you understand the financial and tax implications of selling your family home. These professionals can help you make informed decisions and ensure that you are making the best choices for your family’s financial future. By working with these experts, you can feel confident that you are making informed and informed decisions that will ultimately benefit your family.

Some questions we recommend to ask yourselves:

- Does the group want to sell? Some family members do, some don’t?

- Do some family members believe that work, repairs or home improvements should be done?

- Do some want to sell “as is”?

- Do some family members want to use the home for vacation rental income?

- Is there a reverse mortgage on the property?

- Financially what does each path look like? We can help you determine all this.

TOOLS TO HELP YOU DECIDE

1. get a professional REAL ESTaTE appraisal

A professional real estate appraisal is a process of evaluating the value of a residential property. The purpose of the appraisal is to determine the market value of the property, which is the amount a buyer would pay for the property in its current condition, in a competitive and open market.

Note that the appraiser’s estimate of the property’s value is not guaranteed, and the final value of the property may be influenced by various factors, such as changes in the real estate market, changes in the property’s condition, and local zoning laws.

Look for a licensed and certified appraiser who has experience in appraising properties in your area. Check their credentials, past work, and references to ensure they are reputable and qualified. Or, feel free to ask us for a referral to a local appraiser we have worked with before and trust.

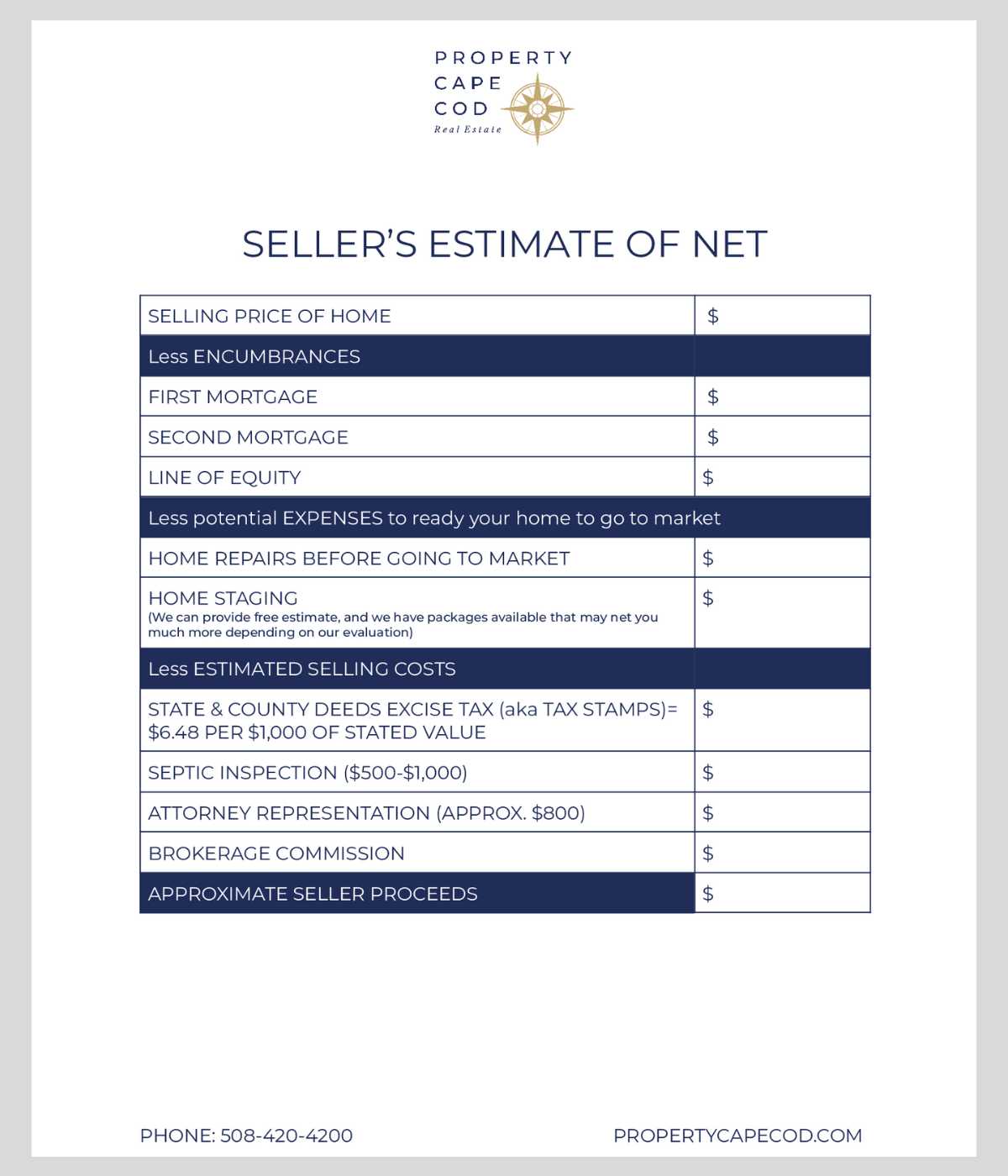

2. seller’s estimate of net

The seller’s net sheet is calculated by taking an estimated home sale price or an offer and then subtracting any encumbrances on the property (outstanding mortgage being the most common), closing costs and miscellaneous fees.

We recommend you

TAKE YOUR TIME

Making a decision about selling a family home after the death of a loved one is a big decision, and it’s important to take the time to consider all the factors involved. Don’t feel pressured to make a quick decision, and allow time for everyone to process their emotions and thoughts before making a final decision.

We are so confident in our services, we offer a 30-day Free Trial.

let’s set up a free strategy session.

We understand family dynamics. We are a local family of 3 generations.